tax sheltered annuity definition

Also known as a tax-sheltered annuity a 403 b plan is an employer-sponsored plan designed for employees of certain tax-exempt organizations eg hospitals churches charities and public. Tax-sheltered annuity TSA A retirement plan that permits an employee of a tax-exempt charitable educational or religious institution to contribute a certain portion of wages or.

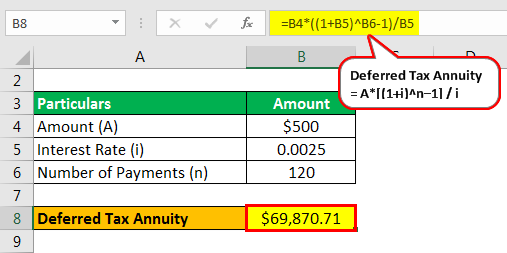

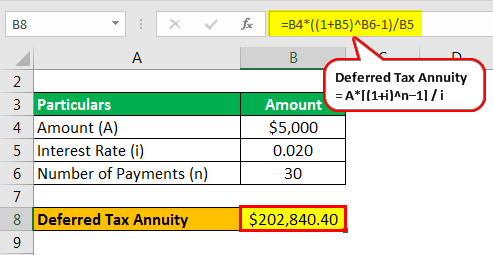

Tax Deferred Annuity Definition Formula Examples With Calculations

Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

. More and more retirees are guaranteeing their money grows without stock-market exposure. Ad Deferred annuity Rates. Ad No stock market exposure just guaranteed growth.

A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Lots of options huge selection. These organizations can set up a TSA.

20 Years Experience Providing Expert Financial Advice. A tax-sheltered annuity TSA also referred to as a tax-deferred annuity TDA plan or a 403 b retirement plan is a retirement savings plan for employees of certain public. Grow Your Money With An Online Multi-Year Guaranteed Annuity MYGA.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Ad Annuities are often complex retirement investment products. A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income.

The employee is not taxed on the contribution until heshe begins to make. Ad Compare Multiple Annuities Each With Their Own Tax Benefits. Ad Get up To 7 Guaranteed Income with No Market Risk.

Learn some startling facts. Its similar to a 401 k plan maintained by a for-profit entity. Online provider of income annuities fixed annuities and the Personal Pension.

Ad Learn More About Tax-Efficient Investing and Retirement Savings at Fidelity. A tax-deferred annuity TDA commonly referred to as a tax-sheltered annuity TSA plan or a 403 b retirement plan is a retirement savings plan available to employees of. A retirement plan in which an employee makes tax-deferred contributions from hisher pre-tax income.

Ad Learn More About Tax-Efficient Investing and Retirement Savings at Fidelity. Get Free Quote Compare Today. Tax sheltered annuities for employees of Section 501 C 3 organizations.

A tax-sheltered annuity TSA is a retirement plan for non-profit organizations such as schools hospitals charities and churches. A type of retirement plan under Section 403 b of the Internal Revenue Code that permits employees of public educational organizations or tax-exempt organizations. This annuity plan is also known.

Tax-Sheltered Annuity is a retirement annuity plan for employees of tax-exempt organizations and public schools to make contributions from hisher income. The tax sheltered annuity is a deferred tax arrangement expressly granted by Congress in IRC Section 403 b.

Tax Sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits

The Hierarchy Of Tax Preferenced Savings Vehicles

Annuity Vs Life Insurance Similar Contracts Different Goals

The Tax Sheltered Annuity Tsa 403 B Plan

Introduction To Annuities Ppt Download

Eac East Asian Community Acronym Business Stock Vector Royalty Free 1526951759

What Tax Deferred Annuities Are And How They Work

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Taxsheltered Annuity Plans Also Known As 403b Plans

Tax Deferred Annuity Definition Formula Examples With Calculations

The Minnesota State Colleges And Universities System Is An Equal Opportunity Employer And Educator Mnscu Retirement Plans Basic Training For Campus Hr Ppt Download

What Does Tsa Mean Tsa Definitions Abbreviation Finder

The Tax Sheltered Annuity Tsa 403 B Plan

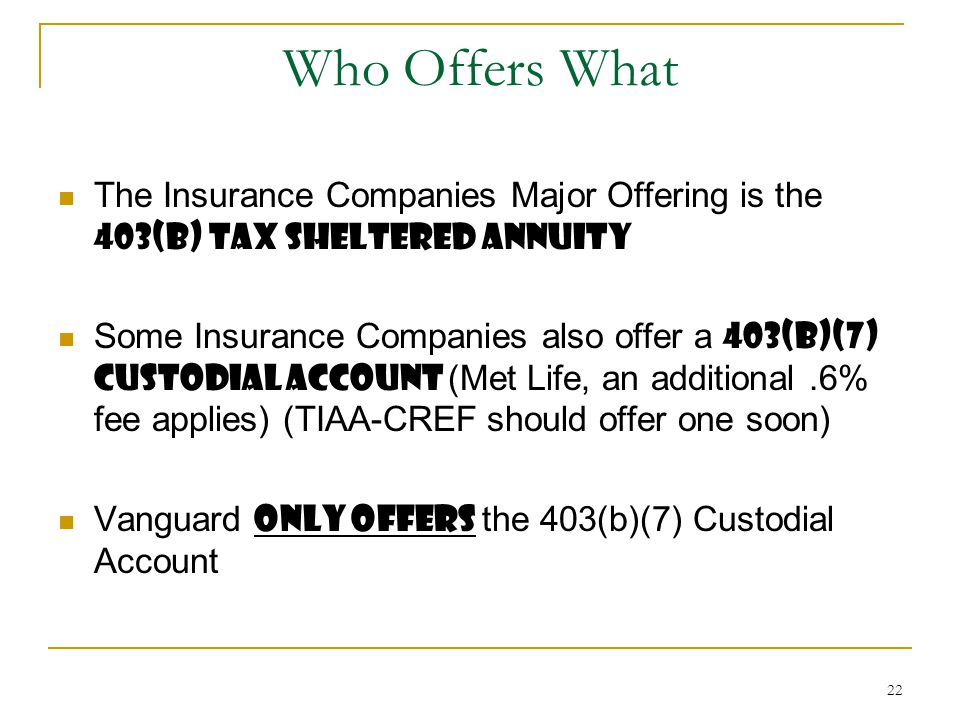

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What You Should Know About Tax Sheltered Annuities The Motley Fool

Annuity Taxation How Various Annuities Are Taxed

Tax Deferred Annuity Definition Formula Examples With Calculations